Download PDF | View documents on Sedar

Montreal, May 26, 2022 – Quebec Precious Metals Corporation (“QPM” or the “Company”) (TSX.V: QPM, OTCQB: CJCFF, FSE: YXEP) is pleased to announce drill hole assay results from drill hole 189 and the six (6) drill holes from the 2022 winter program (7 holes, totalling 2,982 m). The results demonstrate the depth and strike extension of higher gold mineralization for an additional 200 m at the La Pointe Extension gold deposit, on the Company’s 100% owned Sakami project in the Eeyou Istchee James Bay territory of Quebec.

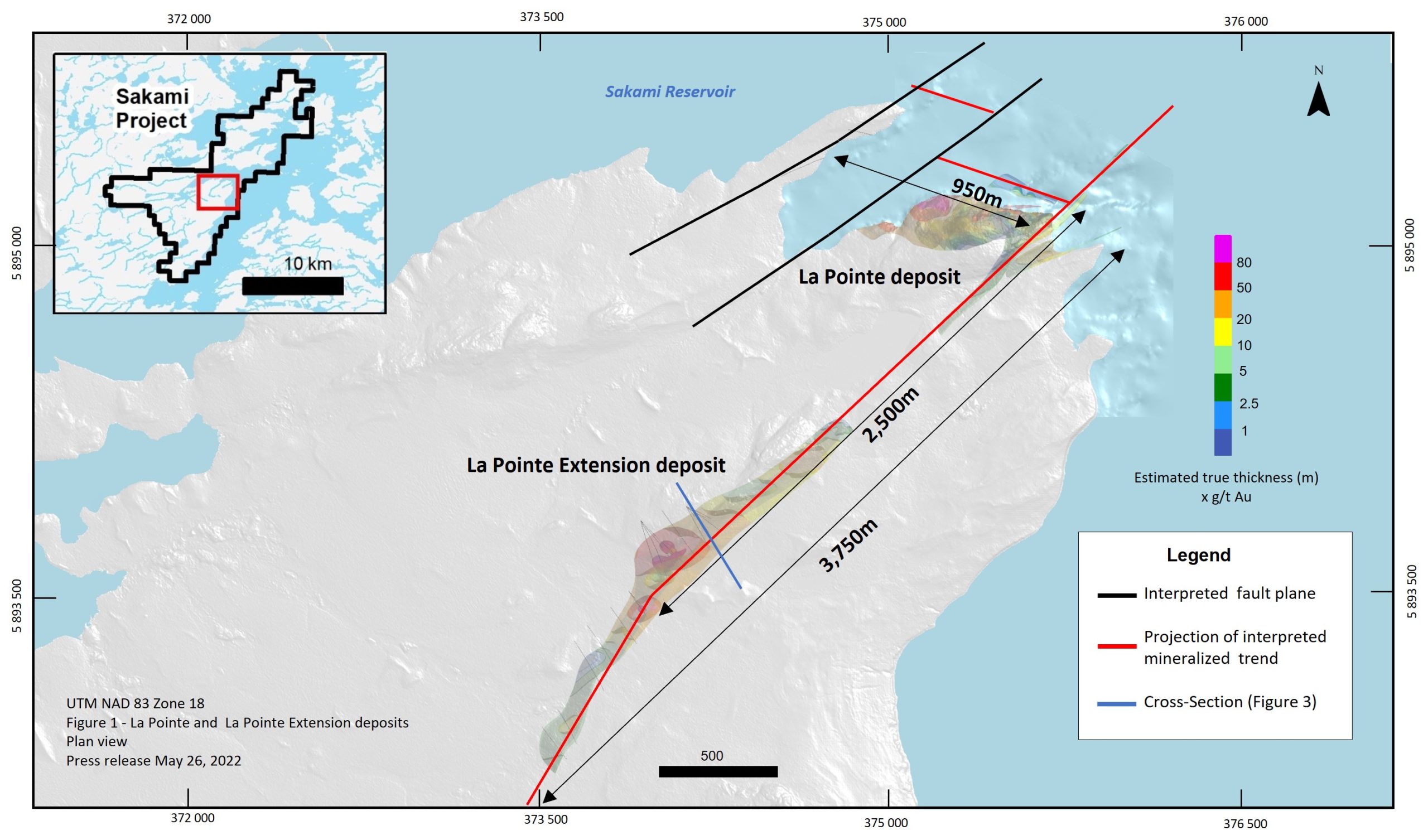

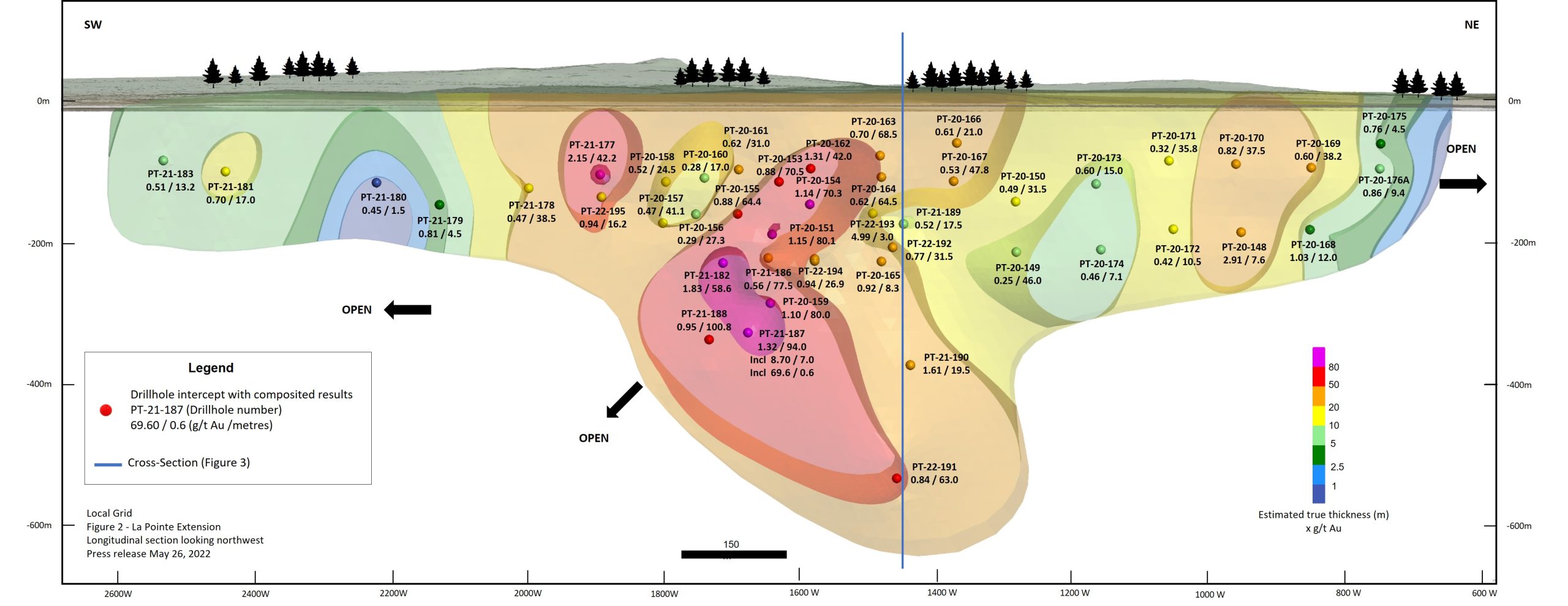

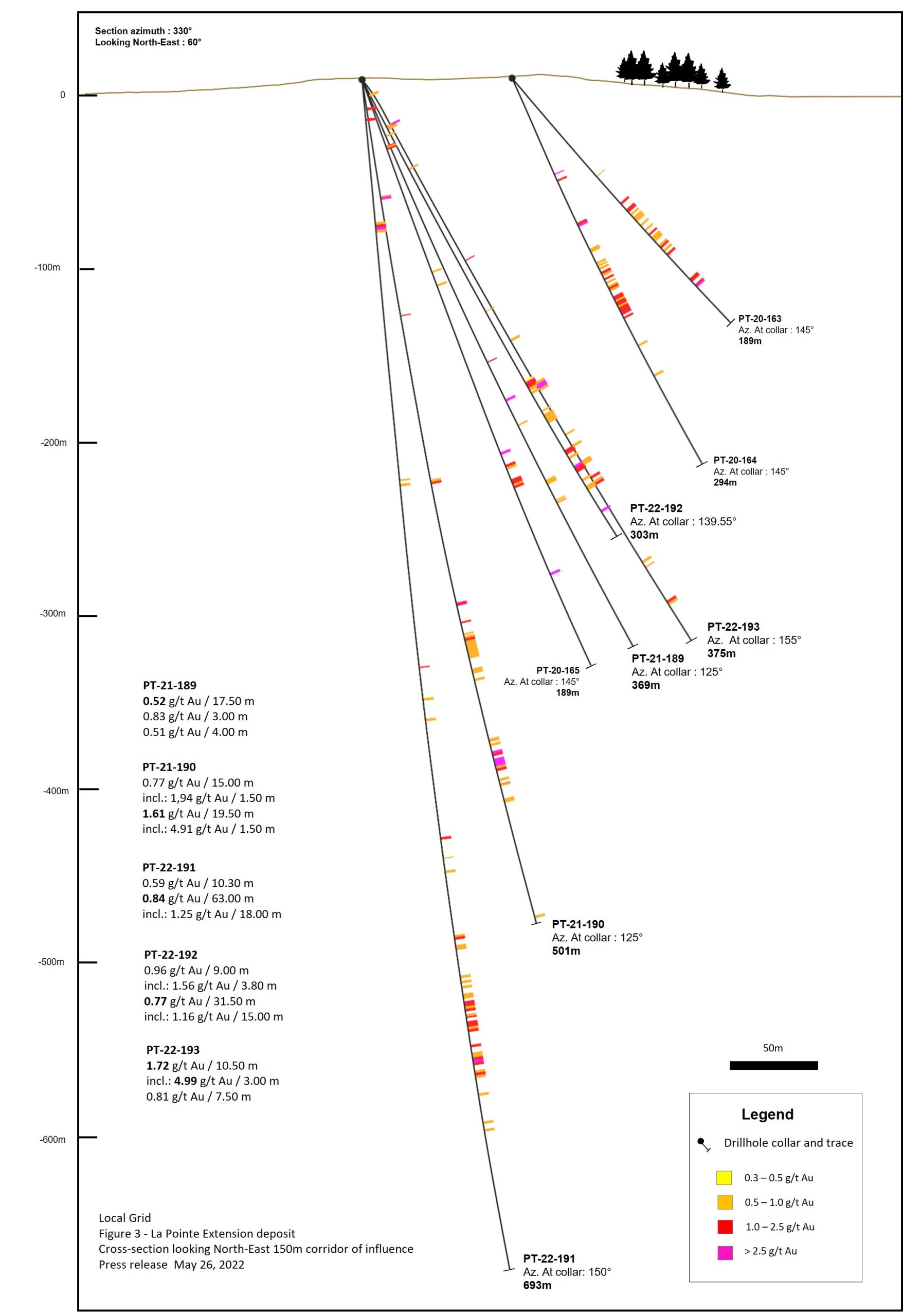

Highlights (Table 1, Figures 1, 2 and 3)

- All seven (7) holes have intersected extensive mineralization over wide intervals.

- The three most significant drill intersections are:

- Hole PT-21-190: 1.61 g/t Au over 19.5 m including 4.91 g/t Au over 1.5 m

- Hole PT-21-191: 0.84 g/t Au over 63.0 m including 1.25 g/t Au over 18.0 m

- Hole PT-21-194: 0.94 g/t Au over 26.9 m including 1.77 g/t Au over 9.0 m

- These holes confirm the continuity of the sub-vertically dipping higher-grade core of the deposit (500 m strike length, a depth of 600 m with an estimated average true thickness of 40 m, up to 75 m in the central part of the deposit, and plunging about 45 degrees to the northeast) which could be amenable to open pit mining.

Normand Champigny, QPM’s Chief Executive Officer, stated: “These results show that the La Pointe Extension deposit keeps expanding at depth and remains open in all directions. The drill results will add an important mineralized volume. In addition, we have numerous undrilled targets in interpreted large intrusive bodies near the deposit and over a strike length of 2.5 km to the south of the deposit. Additional drilling will be required to better define the mineralized zones and to optimize open pit geometries.”

The 2021 fall and 2022 winter drilling aimed to expand the La Pointe Extension deposit that could be amenable to open pit mining. To date, a total of 47 holes (14,535 m) have intersected the La Pointe Extension deposit.

The La Pointe Extension deposit and the La Pointe deposit are part of the Sakami project located along a 23-kilometre-long favourable geological contact that hosts gold mineralization. Both deposits are of similar geological character and a sub-vertically dipping higher-grade portion. They show a generally good spatial correlation between the gold mineralization and the abundance of disseminated arsenopyrite, pyrite and pyrrhotite hosted in a silicified paragneiss that is observed in drill holes. At the La Pointe deposit, the mineralized zone has a strike length 950 m, a depth of 450 m with an estimated average true thickness of 35 m, up to 63 m in the central part of the deposit.

Complete assay results and calculated composite grades released to date are available on QPM’s website. For previously disclosed results in connection with the La Pointe and La Pointe Extension deposits, see press releases of June 9, 2021, November 2, 2021, February 24, 2022 and March 10, 2022.

Quality Assurance/Quality Control

The drilling contract was awarded to Orbit Garant Drilling Inc., based in Val-d’Or, Quebec. The hole diameter is NQ. Quality assurance and quality control procedures have been implemented to ensure best practices in sampling and analysis of the core samples. The drill core was logged and then split, with one-half sent for assay and the other retained in the core box as a witness sample. Duplicates, standards and blanks were regularly inserted into the sample stream. The samples were delivered, in secure tagged bags, directly to the ALS Minerals laboratory facility in Val-d’Or, Quebec. The samples are weighed and identified prior to sample preparation. All samples are analyzed by fire assay with AA finish on a 30 g sample (0.005-10 ppm Au), with a gravimetric finish for assays over 10 ppm Au.

The Sakami Project

The Sakami Project provides the Company with a controlling position over a 23-km long segment of a favourable geological contact and comprises 281 claims (142 km2). It is located 570 km north of Val d’Or, Quebec, 120 km east of the municipality of Wemindji, 90 km from the Éléonore gold mine and 47 km northeast of the paved James Bay Road. Good infrastructure, including major access roads, a hydro-powered electric grid and airports, are present in the region. Drilling can be carried out throughout the year.

Qualified Persons

Normand Champigny, Eng., Chief Executive Officer of the Company, and Qualified Person under NI 43-101 on standards of disclosure for mineral projects, has prepared and reviewed the content of this press release. François Gagnon, P. Geo., Senior Exploration Geologist with Consul-Teck Exploration Minière Inc. has also reviewed the content of this release.

About Quebec Precious Metals Corporation

QPM is a gold explorer with a large land position in the highly prospective Eeyou Istchee James Bay territory, Quebec, near Newmont Corporation’s Éléonore gold mine. QPM’s flagship project is the Sakami project with significant grades and well-defined drill-ready targets. QPM’s goal is to rapidly explore the Sakami project and advance to the mineral resource estimate stage.

For more information, please contact:

Normand Champigny

Chief Executive Officer

Tel.: 514 979-4746

Email: nchampigny@qpmcorp.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This release includes forward looking statements. Often, but not always, forward-looking statements can generally be identified by the use of forward-looking words such as “may”, “will”, “expect”, “intend”, “plan”, “estimate”, “anticipate”, “continue”, and “guidance”, or other similar words and may include, without limitation statements regarding plans, strategies and objectives of management, anticipated production or construction commencement dates and expected costs or production output.

Forward-looking statements inherently involve known and unknown risks, uncertainties and other factors that may cause actual results, performance and achievements to differ materially from any future results, performance or achievements. Relevant factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licences and permits and diminishing quantities or grades of resources or reserves, political and social risks, changes to the regulatory framework within which the entity operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation.

Forward-looking statements are based on the entity and its management’s good faith assumptions relating to the financial, market, regulatory and other relevant environments that will exist and affect business and operations in the future. There are no assurances that the assumptions on which forward-looking statements are based will prove to be correct, or that the business or operations will not be affected in any material manner by these or other factors not foreseen or foreseeable by the entity or management or beyond the entity’s control.

Although there have been attempts to identify factors that would cause actual actions, events or results to differ materially from those disclosed in forward-looking statements, there may be other factors that could cause actual results, performance, achievements or events not to be anticipated, estimated or intended, and many events are beyond the reasonable control of the entity. Accordingly, readers are cautioned not to place undue reliance on forward-looking statements.

Forward-looking statements in this release are given as at the date of issue only. Subject to any continuing obligations under applicable law or any relevant stock exchange listing rules, in providing this information the entity does not undertake any obligation to publicly update or revise any of the forward-looking statements or to advise of any change in events, conditions or circumstances on which any such statement is based.

Table 1: Summary of significant drill hole assay results from the winter 2022 program, Sakami project - Press release of May 26, 2022

Notes:- All widths are drill-indicated core length.

- Drill holes are generally planned to intersect mineralization as close to perpendicular to strike as possible.

- All gold values presented are not capped.

| Hole # | UTM E | UTM N | Length (m) | Azimuth () | Dip () | Number of samples | From (m) | To (m) | Interval (m) | Au (g/t) |

|---|---|---|---|---|---|---|---|---|---|---|

| PT-21-189 | 374117 | 5893902 | 369 | 125 | -65 | 303 | 205.50 | 223.00 | 17.50 | 0.52 |

| 258.50 | 261.50 | 3.00 | 0.83 | |||||||

| 270.00 | 274.00 | 4.00 | 0.51 | |||||||

| PT-21-190 | 374117 | 5893902 | 501 | 125 | -79.7 | 427 | 327.00 | 342.00 | 15.00 | 0.77 |

| Including | 330.00 | 331.50 | 1.50 | 1.94 | ||||||

| 390.00 | 409.50 | 19.50 | 1.61 | |||||||

| including | 402.00 | 403.50 | 1.50 | 4.91 | ||||||

| PT-22-191 | 374117 | 5893902 | 693 | 150 | -85 | 557 | 496.70 | 507.00 | 10.30 | 0.59 |

| 520.50 | 583.50 | 63.00 | 0.84 | |||||||

| including | 535.50 | 553.50 | 18.00 | 1.25 | ||||||

| PT-22-192 | 374117 | 5893902 | 303 | 139.55 | -62.3 | 249 | 198.00 | 207.00 | 9.00 | 0.96 |

| including | 199.10 | 202.90 | 3.80 | 1.56 | ||||||

| 241.50 | 273.00 | 31.50 | 0.77 | |||||||

| including | 244.50 | 259.50 | 15.00 | 1.16 | ||||||

| PT-22-193 | 374117 | 5893902 | 375 | 155 | -60 | 311 | 196.50 | 207.00 | 10.50 | 1.72 |

| including | 202.50 | 205.50 | 3.00 | 4.99 | ||||||

| 264.00 | 271.50 | 7.50 | 0.81 | |||||||

| PT-22-194 | 374012 | 5893887 | 441 | 145 | -60 | 359 | 267.00 | 293.90 | 26.90 | 0.94 |

| including | 271.50 | 280.50 | 9.00 | 1.77 | ||||||

| PT-22-195 | 373873 | 5893541 | 300 | 145 | -70 | 238 | 144.00 | 160.20 | 16.20 | 0.94 |

| including | 150.00 | 156.00 | 6.00 | 1.47 |

- July 17, 2024 Quebec Precious Metals Announces Results of Annual Shareholders Meeting, Grants Deferred Share Units and Stock Options

- June 27, 2024 Quebec Precious Metals Congratulates Ophir on its Spodumene Discovery near the Elmer East Project, James Bay, Quebec

- June 26, 2024 Quebec Precious Metals Granted Financial Support from Quebec Government for Lithium

- June 21, 2024 Quebec Precious Metals Announces Closing of Non-Brokered Private Placement

- May 31, 2024 Quebec Precious Metals Announces First Closing of a Private Placement

- May 28, 2024 Quebec Precious Metals to Issue Shares in Payment of Debts and Deferred Share Units

- April 03, 2024 Quebec Precious Metals and Harfang Exploration Jointly Identify High-Priority Gold and Lithium Drill Targets on their Sakami and Serpent-Radisson Projects, James Bay Region, Quebec

- February 29, 2024 Quebec Precious Metals Intersects 3.86 g/t Au over 8 m and 2.37 g/t Au over 12.2 m on its 100% owned Sakami Project

- January 18, 2024 Quebec Precious Metals Reports High-Grade Lithium up to 3.9% Li2O at Surface at the Drill-Ready Ninaaskumuwin Discovery, Situated along a 3.8 km-long, Highly Prospective pXRF Trend on its 100% Owned Elmer East Project, James Bay, Quebec

- January 16, 2024 Quebec Precious Metals summarizes 2023 progress and provides 2024 outlook

- December 19, 2023 Quebec Precious Metals Intersects Mineralized Zone at La Pointe Extension

- November 23, 2023 Quebec Precious Metals Drilling Higher Grade Mineralization at La Pointe Extension

- November 15, 2023 Quebec Precious Metals Confirms Drill Targets on Lithium Discovery, Elmer East Project, James Bay, Quebec

- November 07, 2023 Quebec Precious Metals Completes Lithium Prospecting Program, Expands Elmer East Project, James Bay, Quebec and Issues Shares in Payment of Debts and Deferred Share Units