Download PDF | View documents on Sedar

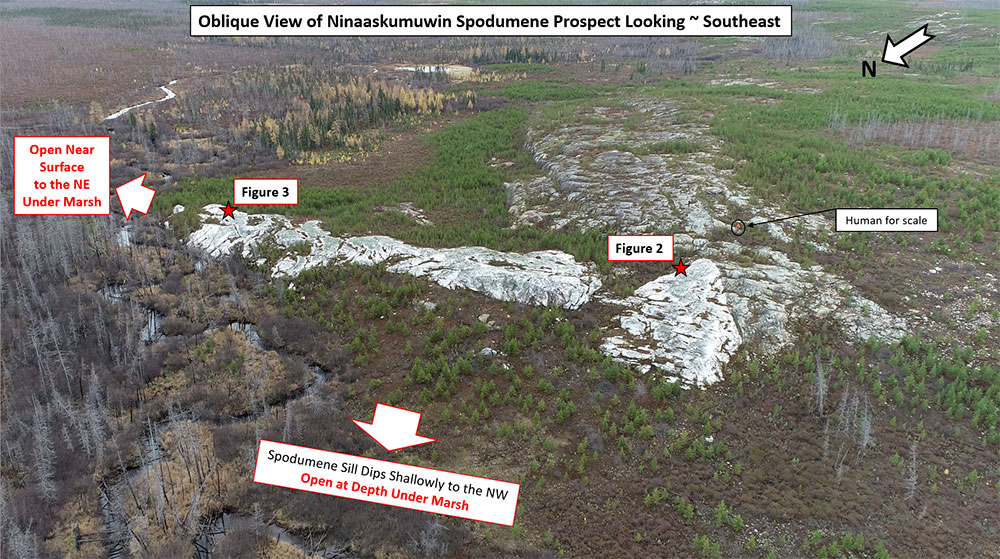

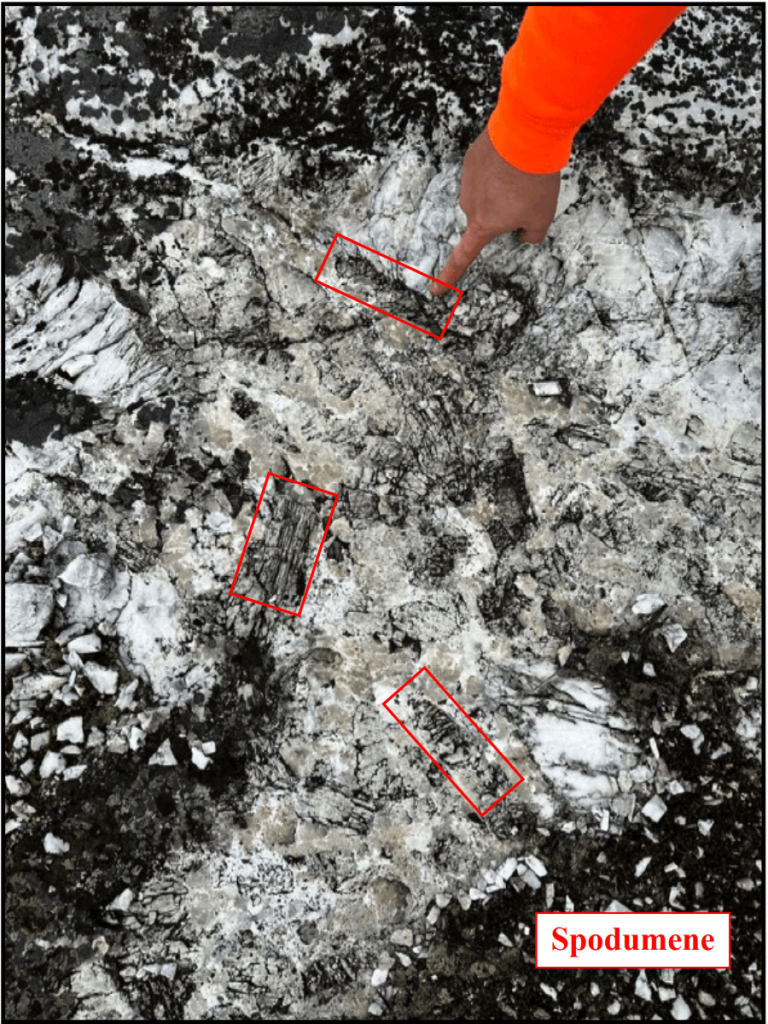

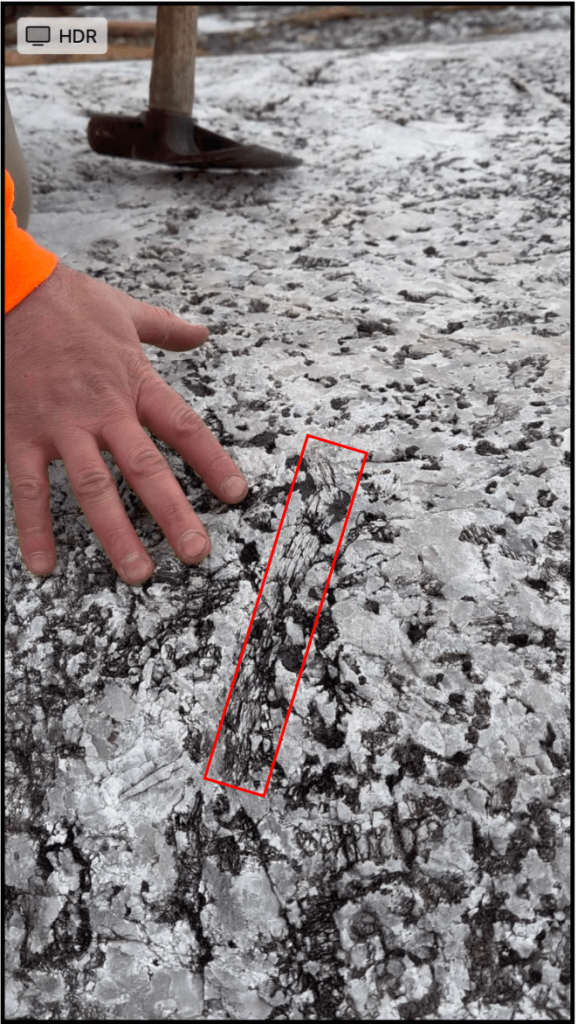

Montreal, November 7, 2023 – Quebec Precious Metals Corporation (TSX.V: QPM, FSE: YXEP, OTC-BB: CJCFF) (“QPM” or the “Corporation”) is pleased to announce the completion of a follow-up prospecting program in the area of the recent Ninaaskumuwin spodumene discovery (see press release October 24, 2023) consisting of geological mapping, structural interpretation and grab sampling. The geological interpretation will be disclosed once available. The first assay values from the prospecting campaign at Elmer East are expected towards the end of November. Photos of the spodumene discovery are presented in Figures 1, 2 and 3, They show large spodumene crystals which are present in the pegmatite rock.

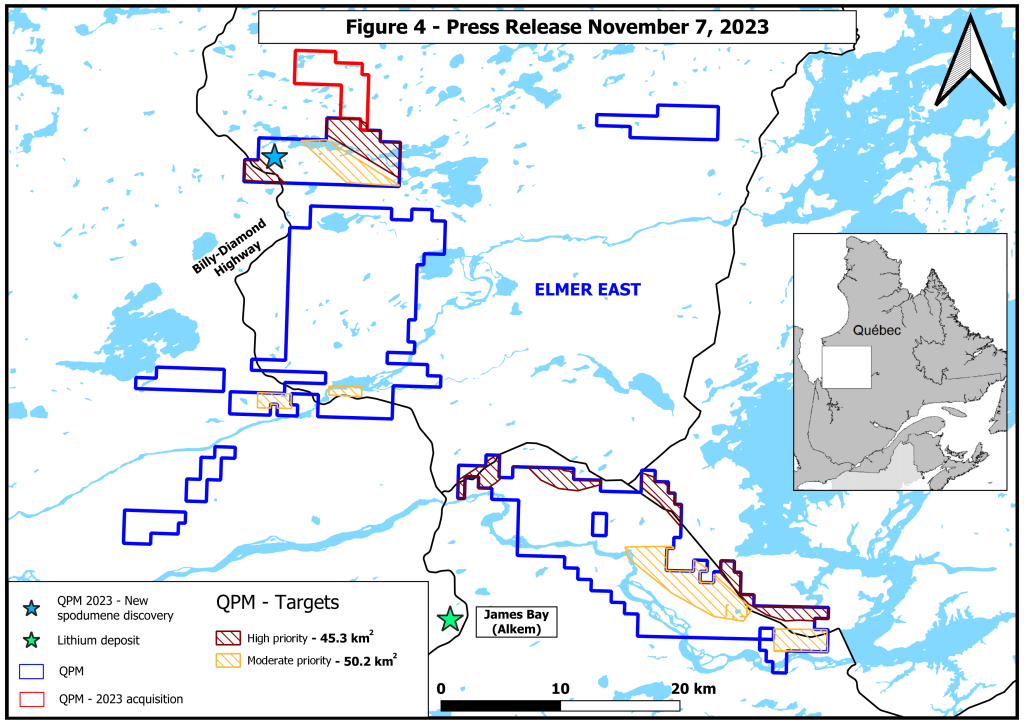

In view of the strong potential lithium potential identified on the high priority targets at the Elmer East project, QPM has expanded the project by staking 40 new claims adjacent to the other areas of interest (see Figure 4). The new claims were added near the Ninaaskumuwin discovery. QPM now has a total of 1,298 claims covering 676 km2, 100% owned by the Corporation in the Eeyou-Istchee James Bay region of Quebec.

“We are even more enthusiastic about the lithium exploration potential at Elmer East, and look forward to receiving the analytical results and plan the next stage of field work.”, commented Normand Champigny, CEO of QPM.

The field work was performed by GeoVector Management Inc. with the guidance of ALS GoldSpot Discoveries Ltd.

Shares in Payment of Debts

The Company announces that it has entered into agreements to issue an aggregate of 194,625 common shares in settlement of debts of three current directors of the Corporation in an aggregate amount of $19,462.50 (the “Debt Settlement”). The Debt Settlement is paid in connection with services rendered by the directors during the third quarter of the financial year ending January 31, 2024.

The Board of Directors and Management of QPM believe that the Debt Settlement is in the best interests of QPM as it will help the Corporation preserve its cash position. The common shares to be issued pursuant to the Debt Settlement will be issued at a deemed price of $0.10 per share and will be subject to a four-month hold period pursuant to applicable securities regulations and the policies of the TSXV.

The Debt Settlement is considered a “related party transaction” as defined under Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The Debt Settlement will be exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as QPM’s securities are not listed on any stock exchange identified in Section 5.5(b) of MI 61-101 and neither the fair market value of the common shares to be issued in the Debt Settlement nor of the services provided in connection with the debts which are the subject of the Debt Settlement exceeds 25% of QPM’s market capitalization. The Debt Settlement is subject to regulatory approval, including that of the TSXV.

Deferred shares units

The Company announces the issuance of 95,000 deferred stock units (the “DSUs”) to the Chief Executive Officer pursuant to its Deferred Share Unit Plan (the “DSU Plan”). This follows the decision that from May 1, 2022, the CEO’s salary compensation will be paid 80% in cash and the other 20% of compensation will be paid in DSUs quarterly. These DSUs represent the portion for the third quarter of 2024.

In accordance with the DSU Plan, the DSUs shall vest in accordance with the terms of agreements granting same and one year from the date of such grant, subject to the provisions of TSX Venture Exchange (the “TSXV”) Policy 4.4 and the Company’s security based compensation plan, and are payable in common shares of the Company, or in cash at the sole discretion of the Company, upon the holder ceasing to be director, officer or employee of the Company.

Qualified Person

Normand Champigny, Eng., Chief Executive Officer of the Company, and Qualified Person under NI 43-101 on standards of disclosure for mineral projects, has prepared and reviewed the content of this press release.

About Quebec Precious Metals Corporation

QPM is primarily focused on advancing its Sakami gold project, located in Eeyou Istchee James Bay territory in Quebec, near Newmont Corporation’s Eleonore gold mine. In addition, the Company holds a 68% interest in the Kipawa/Zeus rare earths project located near Temiscaming, Quebec. This is the only rare earths project in North America which has a fully completed feasibility study.

For more information please contact:

Normand Champigny

Chief Executive Officer

Tel.: 514 979-4746

nchampigny@qpmcorp.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

- July 17, 2024 Quebec Precious Metals Announces Results of Annual Shareholders Meeting, Grants Deferred Share Units and Stock Options

- June 27, 2024 Quebec Precious Metals Congratulates Ophir on its Spodumene Discovery near the Elmer East Project, James Bay, Quebec

- June 26, 2024 Quebec Precious Metals Granted Financial Support from Quebec Government for Lithium

- June 21, 2024 Quebec Precious Metals Announces Closing of Non-Brokered Private Placement

- May 31, 2024 Quebec Precious Metals Announces First Closing of a Private Placement

- May 28, 2024 Quebec Precious Metals to Issue Shares in Payment of Debts and Deferred Share Units

- April 03, 2024 Quebec Precious Metals and Harfang Exploration Jointly Identify High-Priority Gold and Lithium Drill Targets on their Sakami and Serpent-Radisson Projects, James Bay Region, Quebec

- February 29, 2024 Quebec Precious Metals Intersects 3.86 g/t Au over 8 m and 2.37 g/t Au over 12.2 m on its 100% owned Sakami Project

- January 18, 2024 Quebec Precious Metals Reports High-Grade Lithium up to 3.9% Li2O at Surface at the Drill-Ready Ninaaskumuwin Discovery, Situated along a 3.8 km-long, Highly Prospective pXRF Trend on its 100% Owned Elmer East Project, James Bay, Quebec

- January 16, 2024 Quebec Precious Metals summarizes 2023 progress and provides 2024 outlook

- December 19, 2023 Quebec Precious Metals Intersects Mineralized Zone at La Pointe Extension

- November 23, 2023 Quebec Precious Metals Drilling Higher Grade Mineralization at La Pointe Extension

- November 15, 2023 Quebec Precious Metals Confirms Drill Targets on Lithium Discovery, Elmer East Project, James Bay, Quebec

- November 07, 2023 Quebec Precious Metals Completes Lithium Prospecting Program, Expands Elmer East Project, James Bay, Quebec and Issues Shares in Payment of Debts and Deferred Share Units